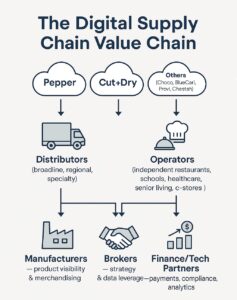

For decades, foodservice distribution relied on phone calls, fax orders, and proprietary portals owned by broadline giants like Sysco and US Foods. But today, a new class of digital platforms—Pepper, Cut+Dry, and others—are rewriting the rules of engagement. While these tools are marketed primarily to distributors and operators, their impact reaches far deeper into the foodservice value chain. For food manufacturers, understanding how these platforms work is no longer optional.

What Pepper and Cut+Dry Do

At their core, Pepper and Cut+Dry provide white-label e-commerce solutions for regional and specialty distributors. These platforms digitize a distributor’s catalog, allowing operators to place orders through a modern, mobile-friendly interface—think of them as Shopify for foodservice.

For operators, the value is obvious: a streamlined ordering process, real-time visibility into inventory and pricing, and the ability to manage multiple suppliers more efficiently. For distributors, it’s a cost-effective way to compete with Sysco and US Foods without investing millions in proprietary technology.

Why It Matters to Manufacturers

Here’s the catch: a manufacturer’s SKU only shows up if it’s in a distributor’s catalog. If a regional distributor carries your line, your product is automatically pulled into Pepper or Cut+Dry. If not, you’re invisible to operators browsing the app. And as operators grow accustomed to digital ordering, visibility within these platforms becomes as important as shelf space in retail.

Even more critical is digital merchandising. Operators searching “plant-based breakfast” or “chicken strips” will see whatever is tagged and promoted by their distributor. If your SKUs aren’t categorized well—or if your broker isn’t actively influencing placement—you may lose to competitors who invest in visibility.

Other Players Entering the Space

Pepper and Cut+Dry are not alone. Similar platforms include:

- Choco – Focused on supplier-restaurant ordering, strong in Europe and expanding in the U.S.

- Cheetah – California-based distributor turned digital-first platform.

- BlueCart – Procurement and inventory management tool.

- Provi – Alcohol-focused ordering marketplace.

Each signals the same trend: digital ordering is moving from “nice-to-have” to “table stakes.”

What It Costs Distributors

Distributors pay subscription fees—often in the low thousands per month—to use these platforms. Compared to the millions it would cost to build their own, the ROI is compelling: lower labor costs, fewer ordering errors, and increased customer stickiness. This explains why adoption is growing quickly among mid-sized and specialty distributors.

Foodservice Value Chain Cheat Sheet

| Who Pays | Who Uses Directly | Who Benefits Indirectly |

| Distributors (monthly subscription, sometimes per-order fees) | Operators (restaurants, schools, healthcare, senior living, c-stores) | Manufacturers – visibility, promotions, and sales data |

| Distributor sales reps (account management, upselling) | Brokers – use data to guide strategy and placement | |

| Finance/Tech Partners – embedded payments, analytics, compliance integrations |

The Takeaway for Manufacturers

Digital distribution platforms aren’t just about efficiency—they’re about shifting influence. As Pepper, Cut+Dry, and others scale, they become gatekeepers of visibility. For food manufacturers, the priority should be ensuring your SKUs are in distributor catalogs, advocating for proper categorization, and exploring opportunities to fund digital promotions.

At Foodservice IP, we are preparing to launch a new Digital Supply Chain study, designed to help manufacturers navigate this emerging landscape. Sponsorship opportunities are now open, and the study will include operator, distributor, and manufacturer perspectives on where digital platforms are headed and how they will reshape product visibility and influence.

In a world where operators expect one-click ordering, success won’t just be about having the right product. It will be about showing up in the right digital window—at the right time.

To learn more about FSIP’s Management Consulting Practice, click here.

Like the content? Sign up to receive our communications.

Recent Comments