In June, Maines Paper and Food Service Inc. filed for Chapter 11 bankruptcy. At $3.5 billion in annual sales, the family-owned company represented the largest and most expansive privately held business based in the Binghamton, Delaware region. According to Forbes, Maines ranked 132nd nationally in privately held companies in 2018.

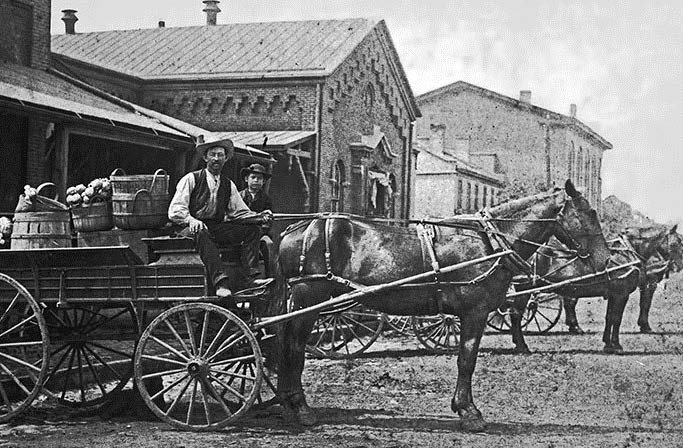

Reid-Murdoch Co., 1850s, a precursor of U.S. Foods. (IFDA.org)

While COVID-19 has already proven to be a nail in the coffin for distributors like Maines Paper, economists and foodservice industry experts are struggling to predict how extensive or lasting the effects of pandemic will be, due to many underlying factors and the unprecedented global scale of the crisis.

In this blog post, Foodservice IP (FSIP) will take a short trip down memory lane to show you where we’ve been and to reveal where foodservice distribution might be heading.

A Long and Storied History

Many foodservice distributors can trace their roots to companies that supplied wagon trains heading West with provisions. Monarch Foods, for example, shares lineage with Reid-Murdoch Co., a Dubuque, Iowa company founded in 1853. Monarch Foods later became part of U.S. Foods.

According to IFDA, by 1869, the completion of the transcontinental railway ushered in the need for Americans to eat on-the-go and away-from-home. As the nation’s infrastructure grew and the public became more mobile, food distributors began to expand their product lines to fill the needs of the flourishing U.S. foodservice industry.

Foodservice distributors now safely and efficiently deliver 225 million cases of food and supplies to more than 1 million professional kitchens across the U.S. every day. Prior to the COVID-19 crisis, foodservice distribution was a $303 billion industry that employed 350,000 people.

Far-Reaching Covid-19 Disruption

Brooks Martin, President and COO of Martin Brothers Distributors, wrote in a June 2020 column that foodservice distributors have experienced revenue losses of between 60 – 90 percent since mid-March. Even as reopening begins in many states, the foodservice distribution industry expects to lose up to $24 billion in revenue through mid-June.

Additionally, Martin estimates that as many as 15 percent of restaurants will close permanently, leaving distributors with uncollectible accounts receivable balances, which pose a significant threat to the financial viability of the overall food service industry.

A Pivot to Grocery

Sysco and US Foods, the country’s two largest restaurant and foodservice distributors, are pivoting to supplying grocery stores.

Sysco is turning its focus to the grocery supply chain, which is not a segment that the company usually serves. Typically, restaurants account for 62% of Sysco’s sales. US Foods has struck new deals to support and sell to grocery stores and has also partnered with C&S Wholesale Grocers to transfer US Foods’ workers to similar jobs with the grocery distributor.

But new grocery sales won’t completely offset the lost sales from restaurants and foodservice operators, like arenas, schools and universities. Sysco pulled its long-term outlook and US Foods withdrew its fiscal 2020 forecast in March. Another challenge is that not all products are easily transferable to retail which means distributors may need the added resources and costs to make the appropriate retailer adjustments.

Expect Changing Business Models Driven by E-commerce

E-Commerce is changing traditional business models (Sana Commerce 2019 Whitepaper)

The main driver for a notable change in business models is the growing prominence of e-commerce. E-commerce is giving companies a unique opportunity to reach customers. For wholesalers and suppliers, this means they can sell directly to end-customers to maximize efficiency and boost profit margins. We have observed the phenomena in the retail space with Amazon, Airbnb, and Uber, but it is also increasing in the B2B space.

In 2018, Unilever Food Solutions acquired FoodserviceDirect Inc., which sells to restaurants, hospitals and schools. FoodserviceDirect carries more than 250,000 items and disposable packaging products.

When restaurants and schools across the nation started closing due to the coronavirus pandemic, Unilever shifted to a B2C model at an opportune time. According to Adeel Murtaza, head of e-commerce technology at FoodserviceDirect, their B2C sales have increased by 20% (from 25% to 45% percent) since the pandemic began.

The Bottom Line

While the future is certainly uncertain, FSIP believes that foodservice distribution will remain a necessary and valuable service that will prevail due to three key factors:

- Partnerships. As Brooks Martin pointed out, foodservice distributors serve as a “bank” for America’s foodservice operators, who would otherwise not survive on a cash-only basis.

- Customer Service. Excellent customer service is at the heart of the success equation. Distributors will go the extra mile and fill a void that is necessary in the value chain.

- Agility. We may see far fewer broadline distributors when the pandemic ends, but what remains clear is those who understand the need to adapt to new business models will be far more likely to survive and thrive.

Recent Comments