This week, FAT Brands, owner of Fatburger and Hurricane Grill & Wings, announced it partnered with ghost kitchen facility Epic Kitchens in Chicago. CEO Andy Wiederhorn said offering multiple off-premise channels is crucial during the coronavirus because “ghost kitchens are an immediate way to get additional locations available for delivery versus the long construction times for building a brick and mortar restaurant,” Wiederhorn said.

As the pandemic continues indefinitely, it seems highly likely that cloud, shared and central kitchens will become a permanent structure in the US foodservice industry. The habit of mobile ordering for pick-up and delivery will be tough to break after the pandemic.

Image source: World Central Kitchen, Inc./globalgiving.org

A Primer on Central and Shared Kitchens

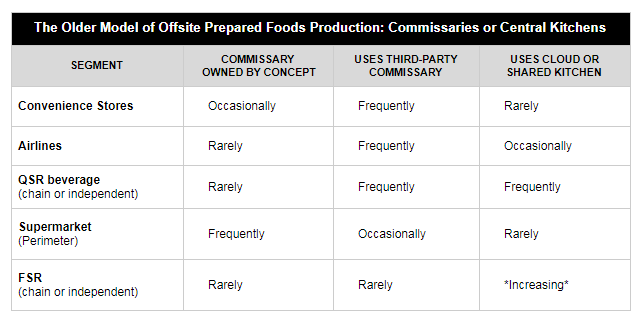

In a nutshell, shared kitchens can house a number of different clients — caterers, bakeries, QSRs, culinary students, etc. Central kitchens, on the other hand, tend to be independent bakeries, delis or sandwich assemblers that provide all or some of their business to other businesses — such as c-stores, supermarket, vending or micromarkets.

Central kitchens can be either owned by the operator (QT Kitchens) or simply outsourced to provide say, a sandwich program to Kroger’s grab and go case or 7-Eleven’s prepared foods. Convenience stores (and vending — not shown) have long been the heaviest users of third-party commissaries/central kitchens.

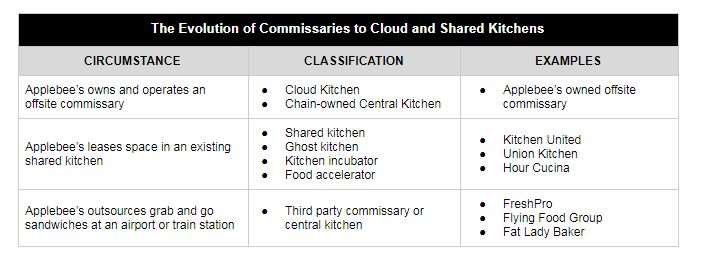

Shared kitchens are often different than even “cloud kitchens” as shown in the table. Using Applebee’s as the example, a kitchen operated by the chain is considered both a central kitchen and a cloud kitchen. However, if Applebee’s outsources its business to say, Kitchen United (as it reported), they are then using a shared kitchen (sharing the space with other QSRs, entrepreneurs, students, etc.)

Centralized Kitchens Are the Residual Effect of Covid-19

Covid-19 has accelerated widespread demographic use of delivery and takeout through mobile devices. This means the number of brick and mortar restaurants will be reduced while centralized production centers will be emphasized. With delivery on the rise, traffic down (even prior to Covid-19) and real estate at a premium, bet on central production centers — whether a cloud kitchen or offsite kitchen to continue to thrive.

Looking for deeper insights around foodservice central production? See our in-depth studies on Selling the Central Kitchens or Opportunities in Emerging Channels such as Ghost Kitchens.

Recent Comments