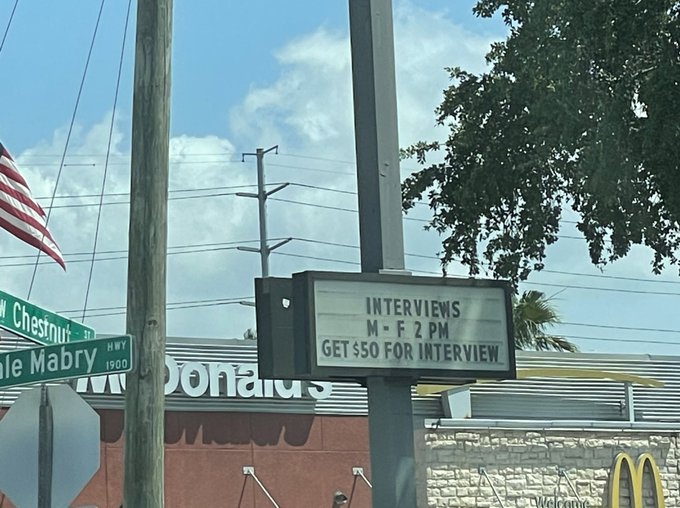

A Tampa Bay McDonald’s (Photo: Dan Nunn)

Restaurants across the U.S. are desperate to hire as outdoor dining season begins, indoor dining restrictions lift, and vaccination rates trend upwards. The problem is, workers are not returning. While the industry lost nearly a third of jobs during the pandemic, potential employees are not applying.

A March survey of members by the National Federation of Independent Business found that 42% had job openings they couldn’t fill. Owners cited higher unemployment benefits as one factor. A study released last month by the National Bureau of Economic Research found that a 10% increase in unemployment benefits during the pandemic led to a 3.6% drop in job applications.

The Incentives To Work in Foodservice Are Lacking

There are few incentives for servers or foodservice workers to return, at least in the short term. And why would they, considering the CARES Act added a $300 supplement to unemployment benefits through September 2021. A Tampa Bay McDonald’s operator offered $50 for candidates simply to apply but received no takers.

One college and university operator we spoke to said while she received a number of applications, many candidates did not respond to follow-up calls. She attributed this to the candidates potentially needing to apply to jobs on a weekly basis to remain eligible for jobless benefits.

Operator Responses to Labor Shortages

While the U.S. is still in the midst of the pandemic, it is challenging to forecast how long social behaviors (fear of social gatherings, mask etiquette, federal payout implications) will linger. Some of the ideas operators in both commercial and non-commercial are considering include the following, which have meaningful implications to manufacturers:

Five Operator Responses to Labor Shortages

| Operator Response | Implications |

| Menu Slimming | With fewer kitchen staff, operators will be faced with only offering items that are in high demand or easy to prepare. |

| Technology | Everything from mobile ordering to delivery to kiosks will continue to thrive, cutting into operator capital. |

| Older Workforce | Older and retired workers have been accepting foodservice jobs, which means tasks must be adjusted that were meant for Gen Z or Millennials. |

| Layout Changes | Stores will likely see more pick-up cubbies, smaller footprints, while on-site foodservice may combine several food stations into one. |

| Reliance on Manufacturers | Operators will, more than ever, look to its supplier partners for industry data and ideas for innovation and high-demand, portable products. |

The end of the third quarter of 2021 is when many experts, including FSIP, expect to see more lasting and sustainable traffic and revenue growth across all of foodservice – both onsite and commercial feeding. Flexible and regular forecasting will continue to be necessary this year.

Recent Comments